Forex Market Forecast in 2024

2024 is here. The team of FBS market analysts is ready to share their insights on the market for the next 12 months, including stock market analysis, metals market prediction, and forex outlook.

The information below will help you build effective strategies for trading Forex, stock, and metals with FBS.

2024 Stock Market Analysis

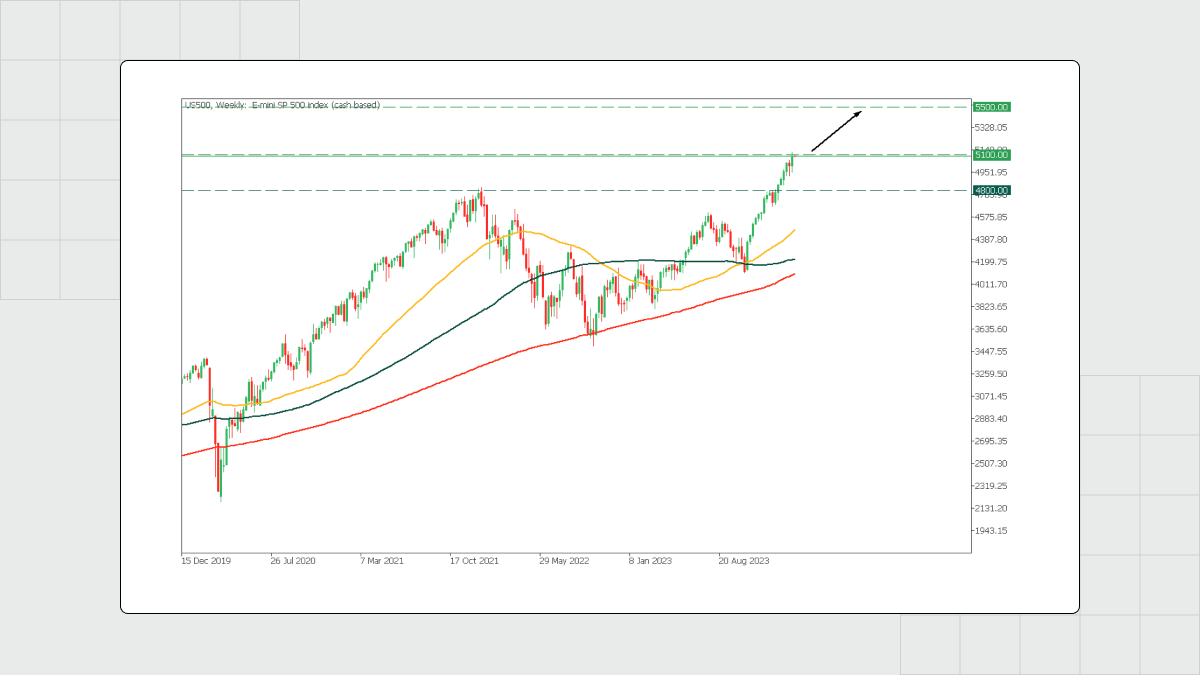

This year’s focus for the stock market is the Fed’s course of action. Mainly whether the Fed will achieve a soft landing for the US economy. Earlier, the data indicated slow but steady economic growth; however, how exactly the Fed’s key decisions and their impact on rates will determine the stock market in 2024 is yet to be seen.

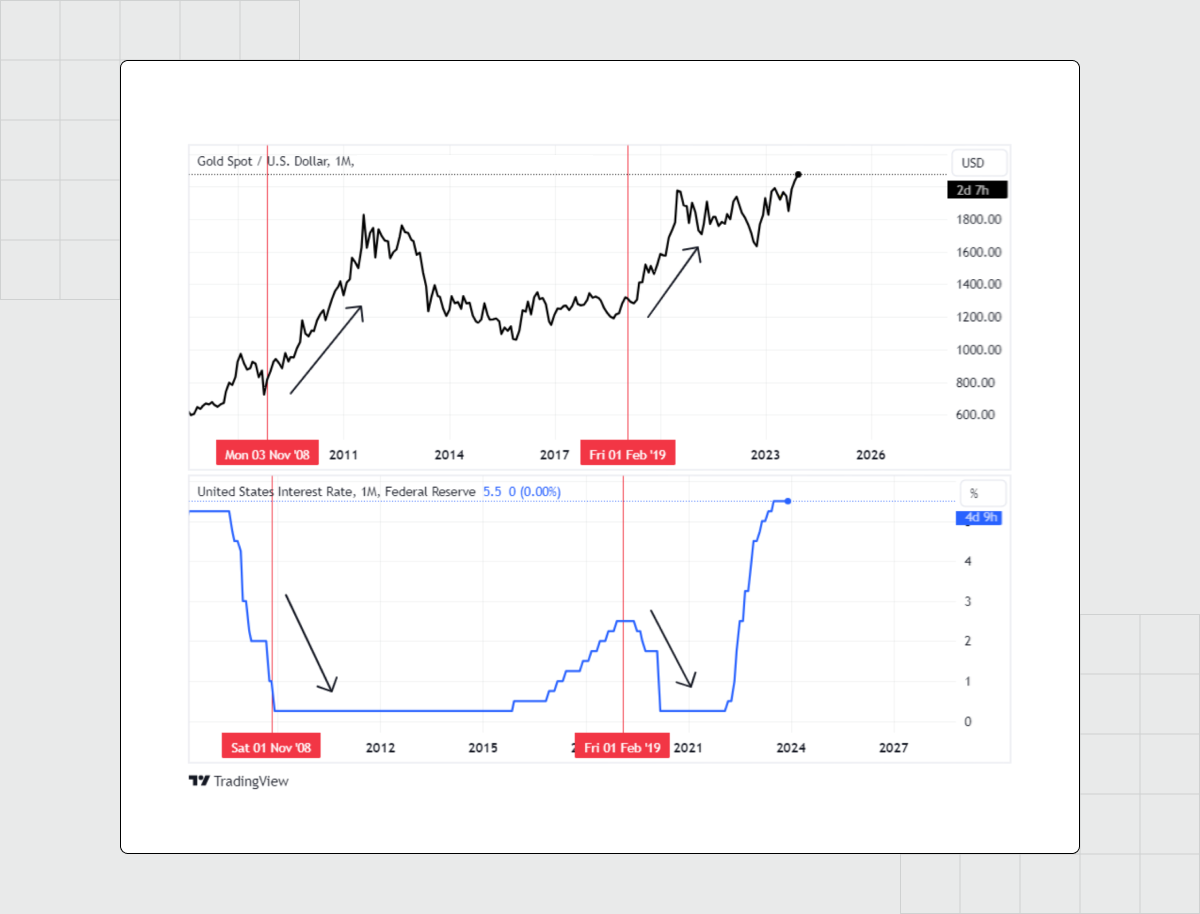

The XAUUSD chart (above); The key rate chart (below).

According to recent data, most analysts believe that a soft landing is possible through cutting rates. While forecasts for the S&P 500 (US500) stock market in 2024 vary, the consensus is for gains to the 5500 level, representing 8% to 9% growth.

The US 500 chart showing the expected consensus.

The 2024 metals market predictions

As for metals market expectations for 2024, they will mostly depend on the geopolitical environment and the actions of the Federal Reserve. Today, the latter is easing its policy. Combined with the current geopolitical risks, this indicates a likely increase in commodity prices this year. Given this information, the outlook for most base metals appears balanced.

The XAUUSD weekly chart.

Taking a closer look at gold, supported by expectations of a Federal Reserve rate cut in 2024, it reached record highs in 2023 and hit a strong resistance level at 2070.00.

Global demand for precious metals is likely to continue in the near term. Long-term interest in safe-haven assets and the outlook for US interest rates will continue to support gold, with the price remaining above $2,000 in 2024.

The chart above shows XAUUSD, below is the yield on US Treasuries.

One of the key factors affecting the price of gold is the US Treasury bonds. So, paying close attention to how the bond yields change is crucial. During significant increases in bond yields, the gold may drop in demand. On the other hand, a decline in Treasury yields may reduce interest in such assets, drawing more attention to gold and pushing its price up.

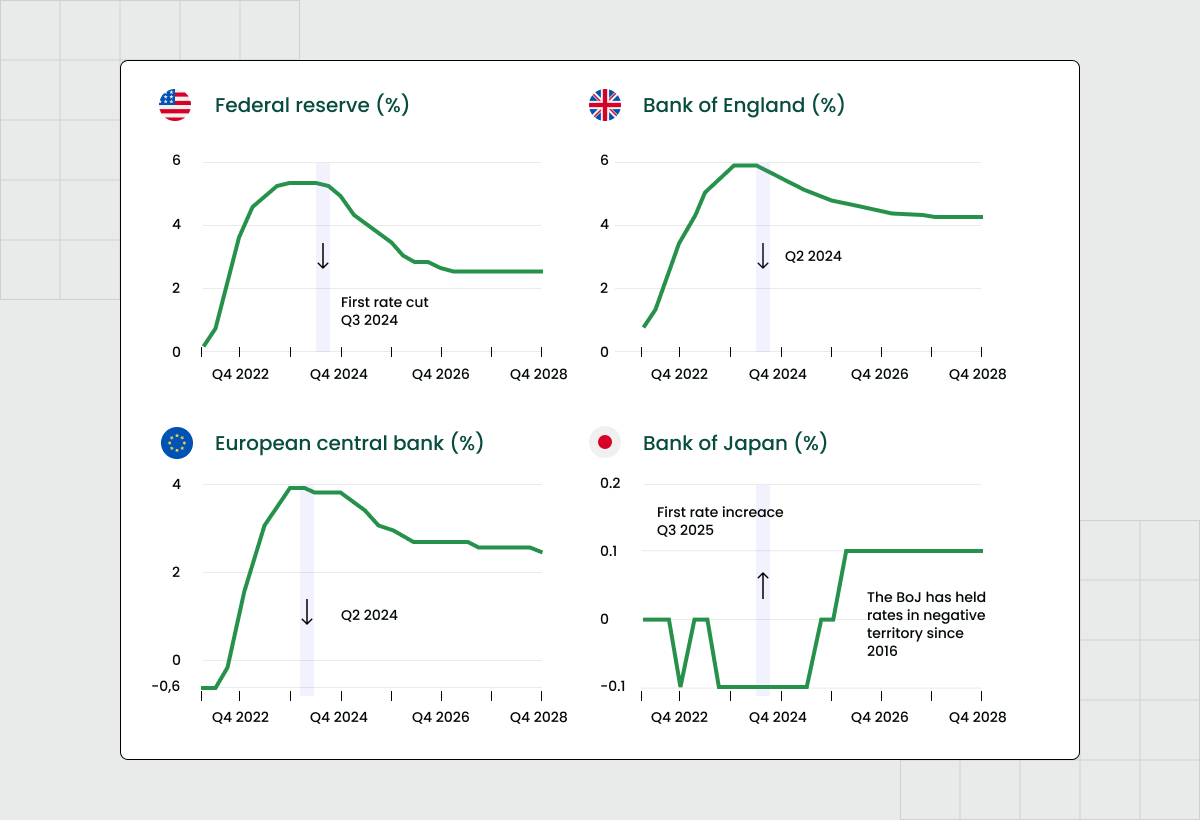

2024 Forex market predictions

This year’s Forex forecast implies strengthening the USD’s bearish trend. This is also important for the second quarter due to the expected decline in short-term rates in the US.

Against this backdrop, EUR and GBP may strengthen but remain exposed to the risks of stagnation in the eurozone and possible early interest rate cuts by the European Central Bank and the Bank of England. The Swiss franc should remain stable against the Euro, reflecting the Swiss National Bank's focus on stability.

Differences in central bank monetary policies drive interest in carry-trade strategies, a harbinger of a resurgence in volatility that will be seen as a key factor in financial strategies in 2024.

Interest rate outlook by country.

Carry trade is an investment strategy in which investors borrow low-interest-rate currency funds and invest them in assets with higher interest rates. This, for example, explains why investors in Japan hold significant amounts of US debt, seeking to benefit from differences in interest rates and generate additional income.

Wrap-up

2024 is going to be a period of challenge and opportunity for financial markets. The stock market forecast focuses on Fed decisions and their impact on the US economy, with slow but steady growth expected. Carry-trade strategies and the prospects of artificial intelligence become relevant in the investment field.

Favorable fundamentals illuminate the commodities spectrum, but global uncertainty calls for cautious optimism. The currency outlook points to an intensifying bearish trend for the dollar, which poses challenges for other currencies. Tense global market dynamics highlight the importance of flexibility and innovation in traders' strategies, making 2024 a time of change and opportunity.

You too can take advantage of the market’s dynamics with FBS. Join us and increase your income by trading the world’s hottest instruments.

FAQ

Can you make Forex predictions?

An adequate FX forecast requires considering many factors, such as possible tightening or easing monetary policy by various countries' central banks, geopolitical events, and economic indicators. Technical analysis of the asset is also essential.

However, specific signals and trends can provide the big picture of what is happening and influence the decision-making of macro regulators. However, realizing that such predictions always carry high risks when trading is crucial.

What is the outlook for USD?

With inflation slowing and the U.S. economy not in danger of recession, Fed officials are increasingly hinting at the possibility of easing monetary policy and lowering interest rates, which could weaken the U.S. currency.

What is the future for Forex?

The development of AI is changing Forex trading significantly, redefining the approach to the industry. AI is used in predictive analytics, where machine learning is used to analyze vast amounts of data quickly and identify trends in the market. This allows traders to make more effective decisions based on real-time and historical data.

One of the key aspects of using AI in the Forex market is forecasting based on sentiment analysis. AI algorithms evaluate subjective data from various sources, such as news and social media, to determine the overall sentiment of traders. This provides valuable information about possible market movements, allowing traders to adjust their strategies. But despite the benefits, AI-based trading comes with risks to be considered.