This article introduces you to a trading strategy that doesn’t require volumes, technical indicators, and price patterns. All you need to do is to be attentive to the price action. Welcome to the Imbalance tutorial.

2023-07-28 • Updated

The DeMarker Indicator was invented and described by Thomas DeMark.

The basic principle is the following: the intraday high of the current day is compared to the intraday high of the previous day. If the intraday maximum of the current day is higher, the corresponding difference is registered. A zero value is recorded if the intraday maximum is less than or equal to the previous day's intraday maximum. Then the differences obtained in this way are summarized. This value becomes the numerator of the indicator, which is divided by the same value plus the sum of differences between the price minima of the previous and current days.

When the indicator is below its lower level – the price may reverse UP. When the indicator is above its upper level – the price may reverse DOWN.

Instruments: any

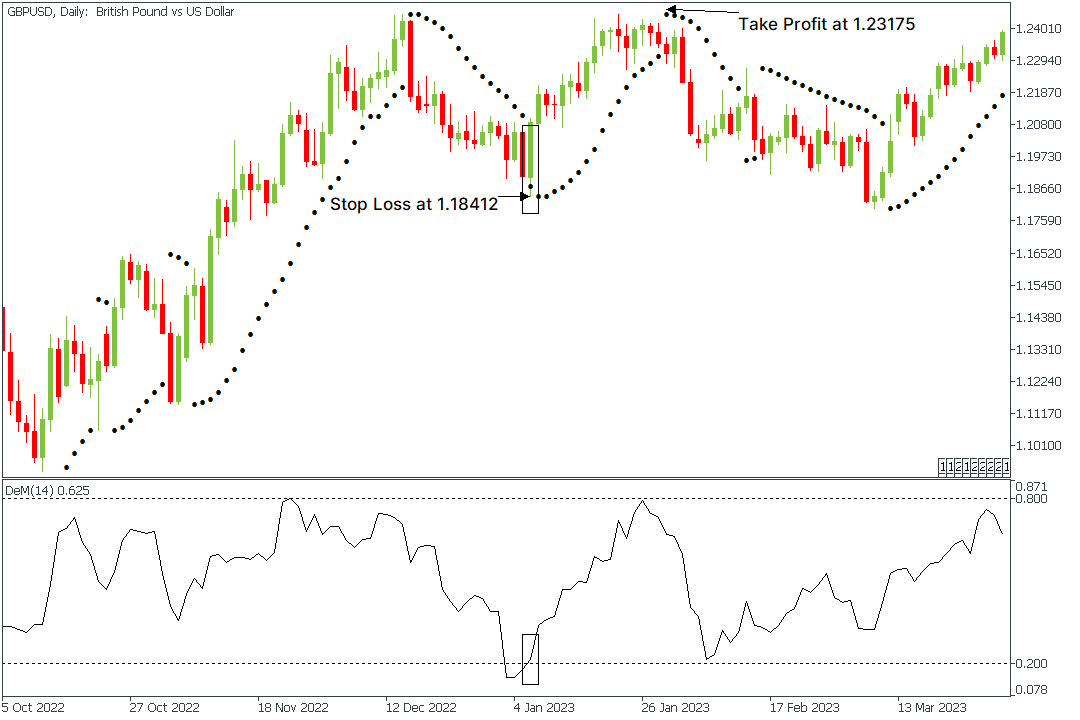

Indicators: DeMarker, Parabolic SAR

Settings: change the levels of DeMarker to 0.2 and 0.8.

Timeframe: >30M

It is recommended to use the Stop Loss at the level of the nearest local minimum before receiving the signal.

For example, we open a long position in GDPUSD at 1.20880 when the Parabolic SAR indicator starts moving UP, and simultaneously, the DeMarker line crosses its lower line. Stop Loss is at the lowest low – at 1.18412.

We kept holding a trade until Parabolic SAR changed its direction and started falling – at 1.23175.

We made 2295 points of profit.

It is recommended to use the Stop Loss at the level of the nearest local maximum before receiving the signal.

We open a short position in GDPUSD at 1.40013 when the Parabolic SAR indicator starts moving DOWN, and simultaneously, the DeMarker line crosses its upper line. Stop Loss is at the highest high– at 1.41829.

We kept holding a trade until Parabolic SAR changed its direction and started rising – at 1.38366.

We made 1647 points of profit.

The choice of Take Profit is possible based on the ratio 3:1, i.e. trade should bring 3 points of profit for one lost profit point.

Another way to choose a Take Profit is to check the Parabolic SAR. If the indicator starts changing direction – it’s time to close positions.

It’s essential to pay attention that the strategy works only in trends. When there is a flat in the market, the strategy may give a lot of false signals.

Trade with FBS using the DeMarker Indicator and Parabolic SAR and get a stable profit.

This article introduces you to a trading strategy that doesn’t require volumes, technical indicators, and price patterns. All you need to do is to be attentive to the price action. Welcome to the Imbalance tutorial.

This article explores the MACD + RSI trading strategy and how it can be effectively employed to identify trade opportunities in the forex market.

Bill Williams is the creator of the most popular market indicators: Awesome Oscillator, Fractals, Alligator, and Gator.

If you are 18+ years old, you can join FBS and begin your FX journey. To trade, you need a brokerage account and sufficient knowledge on how assets behave in the financial markets. Start with studying the basics with our free educational materials and creating an FBS account. You may want to test the environment with virtual money with a Demo account. Once you are ready, enter the real market and trade to succeed.

Click the 'Open account' button on our website and proceed to the Trader Area. Before you can start trading, pass a profile verification. Confirm your email and phone number, get your ID verified. This procedure guarantees the safety of your funds and identity. Once you are done with all the checks, go to the preferred trading platform, and start trading.

The procedure is very straightforward. Go to the Withdrawal page on the website or the Finances section of the FBS Trader Area and access Withdrawal. You can get the earned money via the same payment system that you used for depositing. In case you funded the account via various methods, withdraw your profit via the same methods in the ratio according to the deposited sums.

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!