Ketahui mengapa FBS mengurangkan spread GBPCAD dan apa yang perlu dilakukan seterusnya!

2023-03-30 • Dikemaskini

In today's article, we will be performing an interesting analytical experiment - Correlation!

To start, I have chosen a few indices that we will be observing. It's just like we're analyzing the flavors of different ice creams and predicting which ones will sell better based on their ingredients. In this case, the price action is the component we will adopt in order to determine the outcome. So, let's dive into the price action!

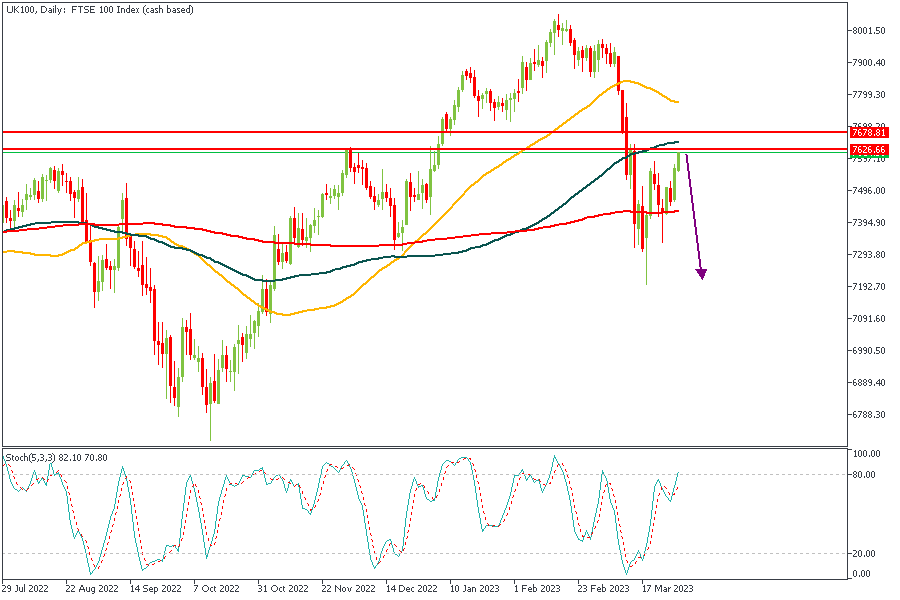

First on my list is UK100, and I'll be working on the Daily timeframe. Here we see price currently at a strong pivot zone acting as a resistance. The 100-Day MA also overlaps with this zone and adds extra confirmation to the possibility of a bearish rejection from the supply zone. The primary target would be the 200-Day MA. You notice the stochastics seems overbought too right? Cheers!

Analysts’ Expectations:

Direction: Bearish

Target: 7440.00

Invalidation: 7708.97

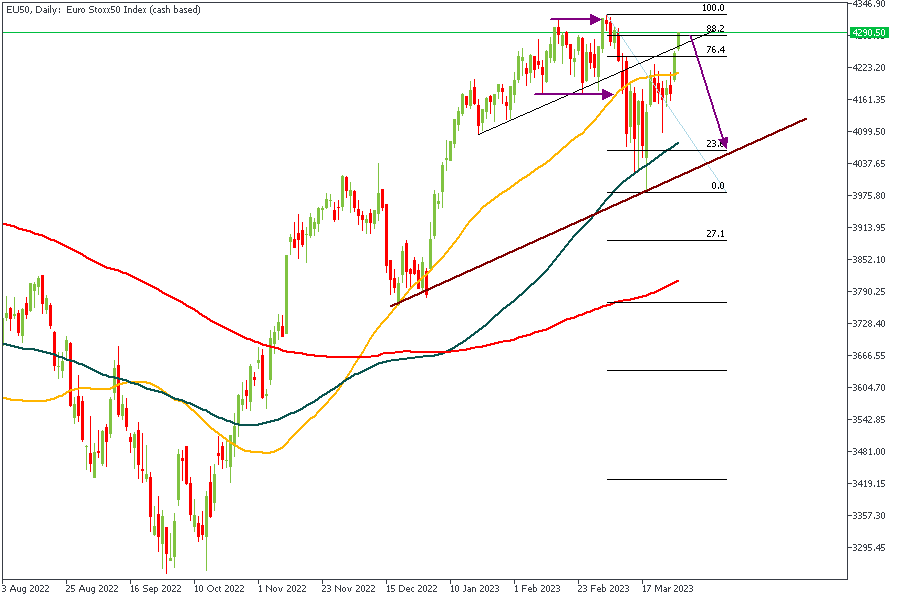

EU50 has created a classic AMD (Accumulation-Manipulation-Distribution) pattern. There has also been a break of the trendline that would act as the pivot in this case; thus making the current bullish move a mere retracement. There is also the confluence of the 88% Fibonacci retracement level, which leads me to believe that price may seek to return to the lower trendline for support.

Analysts’ Expectations:

Direction: Bearish

Target: 4082.5

Invalidation: 4342.30

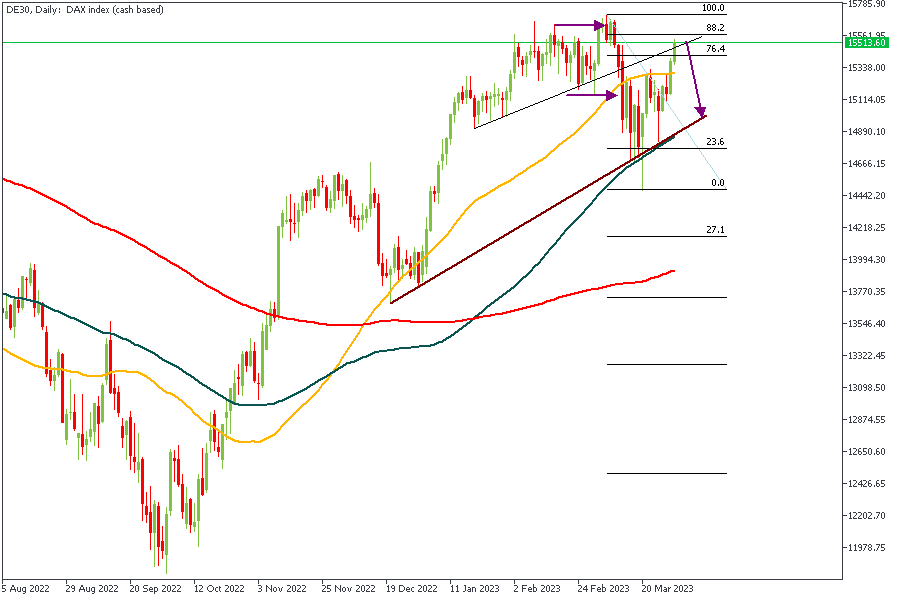

EU50 and DE30 seem to be members of the same book club. Do you see the resemblance in the price action? We have the same AMD pattern, the same Fibonacci retracement level, and the same trendline situation going on. All these simply affirm the likelihood of bearish price action in a short while.

Analysts’ Expectations:

Direction: Bearish

Target: 4084.63

Invalidation: 4337.94

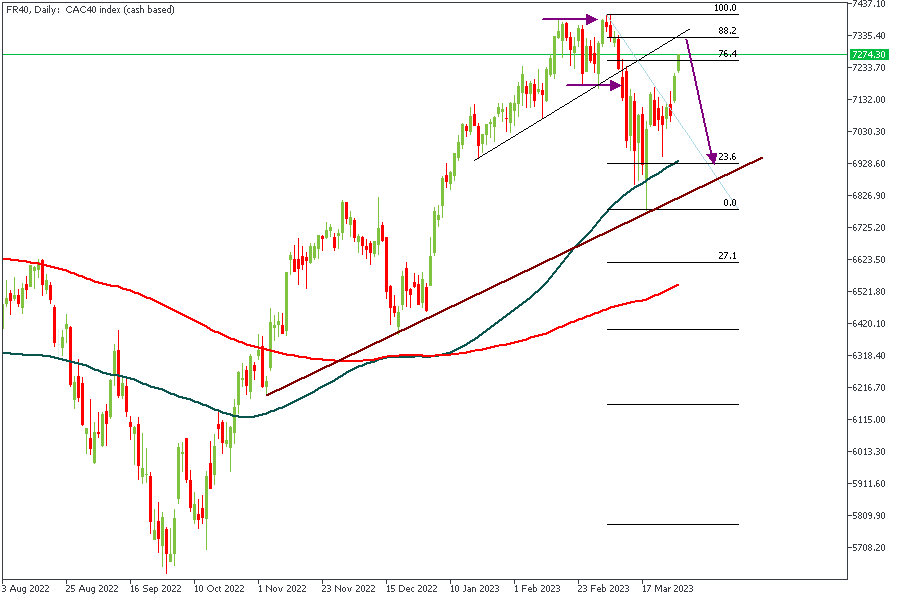

Alas! The book club has one more member here. The price action on FR40 at this point really needs not much explanation; in fact, you could simply refer to the analysis for EU50 or DE30, and you'd still be on point.

Analysts’ Expectations:

Direction: Bearish

Target: 6951.54

Invalidation: 7426.28

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

You can access more of such trade ideas and prompt market updates on the telegram channel.

Ketahui mengapa FBS mengurangkan spread GBPCAD dan apa yang perlu dilakukan seterusnya!

Kenaikan hara yang berlaku itu adalah sebelum mesyuarat FOMC di mana harga berjaya capai ketinggian 1…

Pengaruh dolar sebagai matawang rizab dunia telah merosot secara beransur-ansur. Adakah mungkin untuk euro menggantikannya? Kami juga tidak pasti tentang perkara itu.

Fed mengumumkan pada hari Rabu bahawa ia membiarkan kadar dasar tidak berubah pada 5…

Jepun melangkah lebih dekat kepada campur tangan mata wang dengan amaran terkuatnya apabila yen merosot ke paras paling lemah dalam kira-kira 34 tahun berbanding dolar…

Sentimen pasaran yang memulih pada pembukaan dagangan awal minggu semalam telah menukar semula haluan pergerakan USD…

FBS menyimpan rekod data anda untuk mengoperasikan laman web ini. Dengan menekan butang "Terima", anda menyetujui Polisi Privasi kami.

Permohonan anda telah diterima

Pengurus akan menghubungi anda dalam amsa terdekat

Permohonan panggil balik seterusnya untuk nombor telefon ini

boleh dilakukan dalam dalam

Jika anda mempunyai isu yang perlu disegerakan, sila hubungi kami menerusi

Live Chat

Masalah dalaman. Sila cuba sebentar lagi

Jangan bazir masa anda – pantau bagaimana NFP mempengaruhi dolar AS dan kaut keuntungan!